The technology sector has become a driving force of global innovation and an attractive opportunity for investors. From well-established giants like Apple and Microsoft to emerging startups, tech companies offer both exciting growth prospects and risks. If you’re looking to learn how to invest wisely in technology companies, you’re in the right place. In this article, we will explore the key steps, strategies, and insights you need to successfully navigate the tech investment landscape and maximize your returns.

What Makes the Technology Sector Unique?

The technology industry is often referred to as the “engine of growth” for the global economy. It spans across a variety of areas, including software, hardware, telecommunications, artificial intelligence (AI), and more. But what makes this sector so appealing to investors is the pace at which it evolves. Unlike other industries, tech companies can innovate rapidly, often creating new markets or disrupting existing ones.

From cloud computing and AI to the Internet of Things (IoT), advancements in technology are transforming every aspect of modern life. As a result, the tech sector offers vast potential for returns. However, with this potential comes volatility. That’s why it’s important to approach tech investments with knowledge and caution.

Why Should You Invest in Technology Companies?

Investing in tech companies has become increasingly popular due to their strong growth potential and innovation-driven business models. Let’s explore why many investors are turning to this dynamic sector:

- High Returns: Tech companies have consistently outperformed many other sectors over the past few decades. Companies like Amazon, Tesla, and Google have seen explosive growth, making early investors significant profits.

- Innovation is Key: The tech sector is home to some of the most innovative companies globally. Tech companies are constantly developing new products and services that can revolutionize industries, which presents numerous opportunities for capital appreciation.

- Resilience: While the tech sector can be volatile, many tech companies have proven to be resilient even during economic downturns. For example, even during market slumps, companies like Apple and Microsoft have remained profitable due to their strong market position and diverse product offerings.

How to Get Started with Tech Investments?

When it comes to investing in tech companies, it’s essential to approach it with a clear strategy. Here’s how you can begin your journey into tech investments:

1. Understand the Different Areas of Technology

The technology sector is broad, and understanding the specific subcategories will help you identify the most promising companies. Some of the key areas to consider include:

- Software Companies: These companies create operating systems, business applications, and other software solutions. Think of companies like Microsoft, Adobe, and Salesforce.

- Hardware Companies: Companies in this segment design and produce physical products like smartphones, computers, and wearables. Apple, Intel, and Nvidia are major players in this space.

- Cloud Computing: With more businesses moving to the cloud, companies offering cloud services like Amazon Web Services (AWS) and Microsoft Azure are seeing significant growth.

- AI and Automation: Companies that use machine learning, robotics, and AI to improve processes and create new products are rapidly gaining traction. Tesla and Google’s parent company, Alphabet, are leading in this space.

By understanding the key areas of technology, you’ll be better equipped to focus your investment efforts.

2. Research Potential Companies

Once you’ve identified the areas of tech that interest you, it’s time to research individual companies. Start by looking at well-established tech giants, but don’t ignore promising startups either. A balanced approach can help you diversify your risk and position yourself for both stable growth and high returns. When researching companies, pay attention to the following factors:

- Financial Health: Examine the company’s revenue growth, profitability, and debt levels. A company with strong financials is generally a safer bet.

- Market Position: Companies that hold a dominant market share in a growing segment are often more stable investments. Look at market trends and how well-positioned the company is to capitalize on these trends.

- Innovation and R&D: How much is the company investing in research and development (R&D)? A tech company’s ability to innovate will determine its long-term success.

3. Diversify Your Portfolio

One of the best ways to minimize risk while investing in tech companies is diversification. This strategy involves spreading your investments across different companies, industries, and even geographies. While it may be tempting to focus on one company or one sub-sector of tech, diversification helps protect you if one part of the tech industry faces a downturn.

There are a few ways to diversify in the tech sector:

- Invest in Different Tech Sub-Sectors: Consider spreading your investments across software, hardware, cloud computing, and AI. For example, investing in a cloud company like Microsoft and an AI company like Nvidia can help you tap into different growth opportunities.

- Exchange-Traded Funds (ETFs): Tech ETFs allow you to invest in a basket of tech stocks. This is a great way to gain exposure to the broader tech sector without having to pick individual stocks.

- Global Diversification: Don’t limit yourself to U.S.-based tech companies. The global tech market is vast, and emerging markets like China and India are also seeing rapid growth in tech innovation.

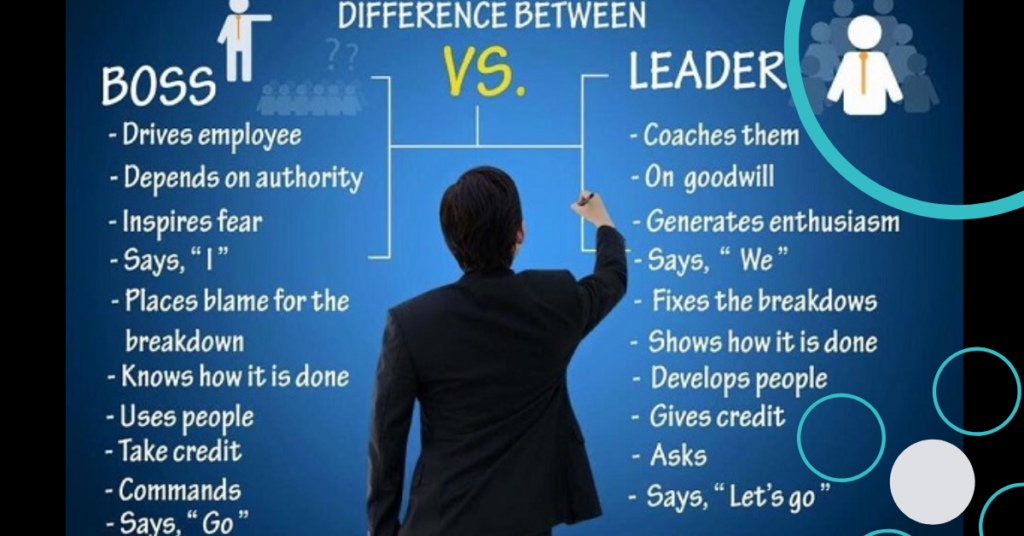

4. Assess the Management and Leadership

A company’s leadership is key to its success, especially in the fast-paced tech industry. Strong leadership can guide the company through challenges and capitalize on new opportunities. Look for companies with a proven track record of innovation and leadership. Some key aspects to evaluate include:

- Experience of Executives: Research the company’s CEO and top executives. Do they have a history of successfully leading tech companies?

- Employee Satisfaction: A happy, motivated workforce can drive innovation. Look for companies with high employee satisfaction and retention rates, as these often correlate with better performance.

- Vision and Strategy: A company’s leadership should have a clear vision for the future, including how they plan to adapt to technological changes and stay ahead of the competition.

5. Understand the Risks Involved

Like any investment, tech stocks come with risks. The tech sector can be volatile, and prices may fluctuate based on factors such as innovation cycles, competition, or regulatory changes. To manage these risks, consider the following:

- Market Volatility: Tech stocks tend to be more volatile than stocks in other industries. This can lead to significant short-term gains or losses.

- Innovation Risk: Not all tech companies will succeed. There’s always the risk that a company’s new product or technology won’t meet expectations, leading to financial losses.

- Regulatory Risk: Governments are increasingly scrutinizing tech companies, especially around data privacy and antitrust issues. New regulations can impact profitability.

By understanding these risks, you can make more informed decisions about which companies to invest in.

The Future of Tech Investments: Where Should You Focus?

The future of technology looks bright, with advancements in AI, quantum computing, 5G, and renewable energy technologies set to revolutionize the market. Investors who stay ahead of these trends can capitalize on the next wave of technological growth. For example:

- AI and Automation: AI is expected to continue transforming industries, from healthcare to manufacturing. Companies that leverage AI will likely see significant growth in the coming years.

- Quantum Computing: Although it’s still in its early stages, quantum computing has the potential to solve problems that classical computers cannot, opening up new possibilities for tech companies.

- 5G: As 5G networks roll out globally, companies providing 5G infrastructure and services will experience rapid growth.

Investing in these emerging trends will allow you to be at the forefront of the next generation of technological innovation.

Conclusion

Investing in technology companies offers immense potential but requires careful planning, research, and a willingness to adapt to a fast-changing market. By understanding the different segments of the tech sector, diversifying your portfolio, and keeping an eye on emerging trends, you can make informed, strategic decisions that set you up for long-term success. With the right approach, you can unlock the rewarding opportunities that the tech industry has to offer.

FAQs:

1. What are the best technology companies to invest in right now?

There is no one-size-fits-all answer to this question because the best technology companies for investment depend on your financial goals and risk tolerance. However, some well-established tech giants like Apple, Microsoft, Alphabet (Google), and Amazon have shown consistent growth and stability. On the other hand, emerging tech companies in sectors like artificial intelligence, cloud computing, and blockchain could offer high growth potential, though they come with higher risk. Always do thorough research and stay informed about market trends before making any decisions.

2. How do I evaluate the financial health of a tech company?

Evaluating a tech company’s financial health starts with reviewing its income statement and balance sheet. Focus on key metrics like revenue growth, profit margins, and debt-to-equity ratio. Technology companies that consistently show high revenue growth and profitability are usually solid investments. However, remember that some companies, especially startups, may not be profitable in the early stages. It’s important to look at their path to profitability and overall market potential.

3. Is investing in technology companies risky?

Like any investment, technology companies come with inherent risks. The tech sector can be volatile, and stock prices can fluctuate significantly based on market conditions or company performance. For instance, new product launches, regulatory changes, or technological advancements (or failures) can greatly impact a company’s success. That said, the rewards can be substantial, especially if you diversify your investments and have a long-term outlook. Risk can be minimized by staying informed, investing in established technology companies, and considering tech-focused mutual funds or ETFs.

4. How can I minimize risk when investing in tech stocks?

Minimizing risk when investing in tech stocks involves diversification, researching thoroughly, and having a long-term perspective. Consider spreading your investments across different sectors within tech, such as software, hardware, and cloud computing, to avoid concentrating your risk in one area. Additionally, focus on established tech giants that have proven their resilience, and be mindful of your overall portfolio’s balance. Regularly monitoring your investments and adjusting your strategy as market conditions change is also a good way to manage risk.

5. What should I look for in a tech company’s leadership?

The leadership of a tech company can significantly impact its success, especially in a fast-evolving industry. Look for a visionary leader who is not only knowledgeable about current technologies but also has a clear roadmap for the company’s future. It’s important to evaluate their experience and track record—have they successfully led the company through challenges or brought innovative products to market? Additionally, a strong and satisfied team behind the CEO can indicate a positive company culture that fosters growth and innovation.

To explore how innovative technologies are reshaping industries beyond real estate, read our in-depth article on how machine learning is transforming financial services.